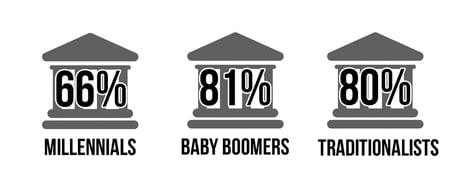

Only 66% of millennials visited a physical financial institution within the past six months.

Financial Institutions are challenged now more than ever to engage all their consumers. Since traditionally the in-person branch and drive-thru experience are what typically brings the most consumer engagement, attracting millennials—and more importantly, keeping them as consumers or members—requires us to step up our game. Because of this, millennials have the most issues with their primary financial institution and low levels of consumer engagement, causing them to go elsewhere.

Because of this, millennials have the most issues with their primary financial institution and low levels of consumer engagement, causing them to go elsewhere.

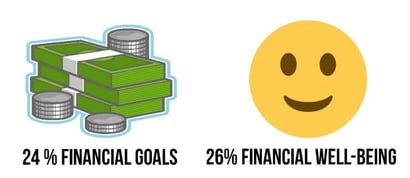

Only 24% of millennials believe their primary financial institution helps them reach their financial goals. That’s quite problematic since this demographic is struggling more than ever when it comes to finances—it’s harder for millennials to stabilize, budget, and reach goals when they are just starting out in the real world.

So how can financial institutions engage millennial consumers when they are least likely to have a personal relationship with their Financial institution?

It’s simple—make the experience AMAZING!

Since face-to-face interactions are sacred, your stakes are high—when the millennial consumer does decide to enter the branch, their consumer experience needs to be amazing. Or else they’ll go elsewhere.

Conversations and transactions are shifting from simple to complex. Millennials need quality, personalized consumer service for everything—from making deposits and withdrawals to paying off student loans and credit cards, saving to buy their first home, and saving for retirement.

Conversations and transactions are shifting from simple to complex. Millennials need quality, personalized consumer service for everything—from making deposits and withdrawals to paying off student loans and credit cards, saving to buy their first home, and saving for retirement.

FI employees must be talented, engaging, and inviting to attract millennials and welcome them anytime they visit a branch. If millennial consumers don’t have in-depth conversations or feel connected to the branch, they will look to bank somewhere else. There must be a shift in how financial institutions interact with millennials to stop this from happening.

Our future is digital.

Millennials lust after and LOVE technology. Since this group is the largest demographic that will shape the financial world, the future will continue to be digital. They prefer a quick, efficient digital experience over brick-and-mortar branches any day.

Millennials are the most likely generation to use both online (92%) and mobile (79%) channels, and they use those channels much more frequently than older generations.

To be successful, FIs should improve their current online and mobile channels and expand their services to help millennials reach their financial goals, such as offering budgeting apps, online bill-pay options, and peer-lending platforms.

To be successful, FIs should improve their current online and mobile channels and expand their services to help millennials reach their financial goals, such as offering budgeting apps, online bill-pay options, and peer-lending platforms.

The best way for millennials to bank is easy and seamless. And that means going digital.

It’s all about the apps.

Since millennials are the first adopters of popular fin-tech platforms—such as Venmo, Apple Pay, and Zelle—they expect well-designed apps that meet their needs. Otherwise, they are quick to abandon mobile platforms that simply don’t measure up.

And it’s not just other banks or credit unions that FIs must compete with—millennials compare their digital banking experiences to all other digital interactions. No pressure, right?

Mobile banking apps must be just as good as the best app on a millennial’s phone to win them over. So, it is worth investing time and effort into creating a stellar app.

Some millennial consumers never step foot into a bank or credit union's branch. They entirely rely on their digital experience. You want them to remain loyal to your FI though, right? Then design an app to engage them and keep them happy.

But don’t forget to target other channels.

We live in an omnichannel world. No matter how much digital interaction seems to take precedent, financial institutions can’t forget to pay attention to other mediums to gain consumer loyalty and carry out branding in those channels successfully.

FIs must be consistent in all channels and align functionality with consumer expectations.

Every channel matters, and what consumers can do with each channel is crucial. No one wants to feel forced to complete certain banking activities on a limited channel. Give them options!

Bring your brand alive in ALL channels—being too concentrated will only hurt your FI in the end. Create an omnichannel experience that’s memorable—Millennials will be your biggest fans!

Source: http://news.gallup.com/businessjournal/231911/ways-banks-win-keep-millennial-customers.aspx?g_source=link_newsv9&g_campaign=item_226847&g_medium=copy