Millennials in the U.S. will control an estimated $7 trillion in assets by 2020. Right now, they are the largest demographic looking to buy their first house.

Why should financial institutions (FIs) care about this? The answer is simple – buying power. Meanwhile, the digital world has created new behavioral patterns and levels of interaction. This is impacting the values of younger generations in how they spend and save money.

Why should financial institutions (FIs) care about this? The answer is simple – buying power. Meanwhile, the digital world has created new behavioral patterns and levels of interaction. This is impacting the values of younger generations in how they spend and save money.

So how do FIs remain players in the game to stay relevant and successful in the millennial world?

Eyes for Design

Millennials love with their eyes. Visual details catch their attention, especially ones that are cutting-edge and innovative. This is why design is so important!

When designing for millennials, they want to experience something trendy and convenient. Offering co-working space or a coffee shop in the FI-things that are better for quick, simple, and efficient communication–are great ideas to get millennials to visit a bank or credit union. They want their experience at the financial institution to be enjoyable and memorable, especially since for many millennials, visiting seems to be a daunting task.

Design is a way of thinking, providing competitive advantages to make a brand stand out against the rest. FI's need to have a more modern design to survive in the age of disruption-Millennials believe that the financial industry is far too conservative. Banks and credit unions need to stay on their toes.

Be cool! For millennials, brands are judged based on beauty. This means that visual channels are dominating their experience, such as social media, apps, blogs, and more.

Millennials would much rather use well-designed social media apps for communicating. They will search for a tutorial or help online instead of contacting someone on the phone. FIs should make sure these services are offered so they don’t have frustrated younger consumers.

Digital World Takeover

Interacting with business reps to solve a problem when using a product or service isn’t always preferred. Use as many channels as possible–try to have a presence everywhere to reach millennials, especially since they control a hefty amount of buying power.

Millennials want a real-time experience that is personal and innovative. This generation grew up in the fast-paced era of new technology, and their banking experience needs to match that.

Millennials want a real-time experience that is personal and innovative. This generation grew up in the fast-paced era of new technology, and their banking experience needs to match that.

Only 25% of banking resources are available online, and many of those resources are not the level of quality that they should be. Since more transactions are online only, millennials prefer to bank using apps and online sites.

What does that mean? Prepare for a cashless society!

Offering digital financial services are not the only thing that millennials care about: they still want that in-person user experience with high-quality, personalized design. That makes finances more enjoyable for them, so they will want to come back.

Truthful and Transparent

Millennials have a different attitude toward privacy: they’re used to sharing their private info, and treat it as an inconvenience if they can’t do something quickly and efficiently. It just makes using the service harder for them, and they really want instant gratification.

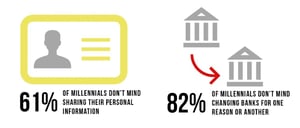

In fact, 61% of millennials don’t mind sharing their personal information with businesses–all because they want that more personalized experience, no matter what. In return, they expect transparency and honesty.

Building consumer-oriented relationships becomes the most crucial aspect in business strategies today. Millennials judge everything by their own experience, which is why creating an amazing experience is imperative. Otherwise, they will switch to a financial competitor. No regrets.

82% of millennials don’t mind changing banks for one reason or another. When banks can gain their loyalty and trust, that's a big win!

82% of millennials don’t mind changing banks for one reason or another. When banks can gain their loyalty and trust, that's a big win!

Mindful Media

Marketing and advertising is totally different when trying to reach millennials–they consume media in an entirely different way. Think TV commercials are the best way to reach them? Think again–Millennials are not traditional media consumers.

They become media themselves.

They also do not forgive mistakes.

News of bad experiences floods social media and blogs quickly, filling thousands of sites. Millennials aren’t afraid to voice their opinions online, and they are in constant interaction with each other. Word spreads fast. Businesses must be careful to not frustrate their millennial consumers, because they could be doomed if bad word gets around.

Valuable Experiences

Millennials are more focused on human values and the meaning of life. They want to live self-fulfilling lives and change the world for the better. They are very human-centric, caring about personalized, high-quality experiences that prove the meaning of a brand’s existence.

To coincide with this, millennials want to spend money on experiences, not necessarily on material things. They want to travel, see the world, and create memories to last a lifetime.

Millennials are driven by FOMO–fear of missing out. FIs should capitalize on this to help millennials achieve their dreams.

Going green is the way to go. Millennials are all about being eco-friendly and saving the planet for future generations – and improving it. Banks need to become “green companies” to keep up with their goals.

The entire consumer journey should be cared about – Millennials want to feel treated like a person, not just a figure in the bank or credit union's financial reports. Care and respect go a long way.

Design a consumer experience to make millennials want to visit your bank. Don’t get cut from the team.

To read our past article about millennials in the financial industry, click the link below.

Source: https://thefinancialbrand.com/69782/digital-banking-millennial-gen-z-experience-design-banking-trends/